For the second time this year, Bank Negara Malaysia (BNM) announced the reduction of the overnight policy rate (OPR) by 25 basis points to 2.50% on March 3, 2020.

At 2.50%, the OPR is at its lowest point since March 2011.

“The reduction in the OPR is intended to provide a more accommodative monetary environment to support the projected improvement in economic growth amid price stability,” announced Bank Negara in a press release.

What is OPR?

The OPR is the interest rate at which a bank lends to another bank, which is set by BNM. This rate has an effect on the country’s employment, economic growth and inflation. It is an indicator of the health of a country’s overall economy and banking system.

Why did BNM reduce the OPR?

The first 25 basis point cut in January was a “pre-emptive measure to secure the improving growth trajectory amid price stability”.

This time, the OPR reduction is meant to encourage an “accommodative monetary environment”. BNM noted that the COVID-19 outbreak has affected production and tourism, leading to higher risk aversion, tighter financial conditions and more financial market volatility.

However, the implementation of policy responses by several countries is expected to mitigate the economic impact of the new coronavirus. The 2020 stimulus package will also provide support.

“For 2020, private and public sector activities will be supportive of growth. Household spending is expected to grow at a slower pace amid moderate employment and income growth. Investment activity is projected to record a modest recovery, underpinned by ongoing and new projects, both in the public and private sectors,” BNM added.

While domestic growth is expected to improve, the prolonged impact of COVID-19 and weakness in commodity-related sectors remain key downside risks.

The headline inflation averaged at 0.7% last year. This year, headline inflation is expected to “average higher but remain modest”.

How does it affect you?

So, what does this mean to Malaysians?

With the 25 basis points reduction in borrowing rates, consumers will be able to see a hike in their disposable income due to the reduction in interest payments. Consumers will have more cash on hand to spend, which will likely spur the domestic economy.

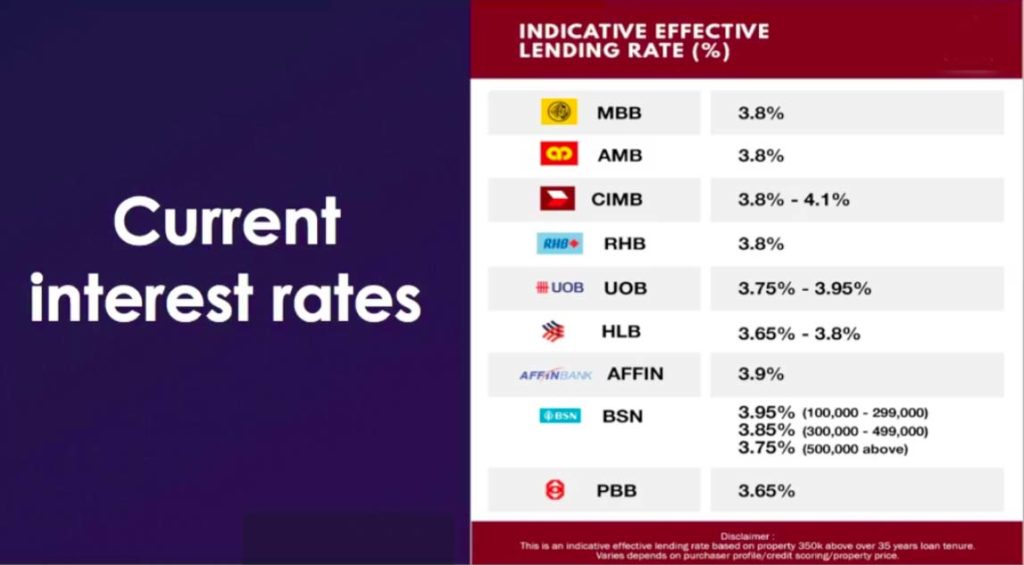

1. Lower loan interest rates

Any changes in the OPR will impact loans that use the Base Rate (BR) or the Base Financing Rate (BFR) to determine the interest rate by which it will lend to consumers.

If the OPR reduces by 0.25%, and banks decide to stick to their current profit margins, then your loan’s BR will also reduce by 0.25%. This will lower your loan’s interest rate.

For example, if your mortgage loan is pegged to the BR, and OPR reduction will lead to a lower mortgage interest rate, which means that you’ll be paying lower monthly repayments. Here’s an example of how this works:

| Loan amount | RM500,000 | |

| Loan tenure | 30 years | |

| BR: 3.65% | BR: 3.65% – 0.25% = 3.40% | |

| Home loan interest rate | 4.45% (3.65% + 0.80%) | 4.20% (3.40% + 0.80%) |

| Monthly repayment | RM2,518.59 | RM2,445.09 |

| Total interest paid over 30 years | RM406,693 | RM380,232.40 |

Based on the example above, the 0.25% reduction will result in RM26,460.60 savings over a 30-year loan tenure. Borrowers will be able to see about RM73.50 reduction in their monthly repayment based on the example above. Over the loan period, you can see a savings of 6% and a monthly savings of close to 3%.

2. Lower returns for savings accounts and fixed deposits

Though an OPR reduction is good news for those taking out property loans, savers looking for more returns on their savings accounts and fixed deposits will be disappointed. The interest rates for these savings instruments will be reduced in tandem with the OPR cut.

But this won’t affect any fixed deposits that you have placed prior to the bank’s revision of fixed deposit rates.

OPR cut’s effect on economy and business

• Economy: The rate cut’s intention is to boost spending, reduce deflation with a corresponding reduction in the price of goods and to boost the overall Malaysian economy.

• Business: Generally positive as most businesses will fare better with lower borrowing costs and increased domestic consumer spending. Sectors that will benefit include property, construction, discretionary goods, and exporters.

• The exception: This would be banks and importers who will need to pay more to bring in goods purchased with a weaker Ringgit.

• Banks: Reduced profitability with lower interest rates and profits reduced. The impact on banks’ net profit is expected to be around -3%.

OPR cut’s effect on individuals

How does this affect the average Malaysian?

• Fixed Deposits: Lower returns for fixed deposits that have not been locked-in prior. Funds to be placed in a fixed deposit should have been done before banks revised their rates.

• Equities: Generally a boost for equity markets as most companies perform better with lower borrowing costs and increased spending by consumers. The equities market is a leading indicator meaning that its effect will be seen faster than the economy.

• Bonds: Generally fixed rate bonds will increase in value as bonds become more attractive when interest rates drop. In short, bonds have an inverse relation with interest rates meaning bond prices go up when rates go down and vice versa.

This affects long-term bonds more than short-term bonds as there is a longer payment duration affected.

• Property loans: Variable rate loans including home mortgages interest rate will go down in tandem. Property loan repayments will reduce approximately RM10 monthly for every RM100,000 in loan amount.

• Currency: The Ringgit is expected to weaken with the rate cut due to lower yield and capital outflow. Foreign funds may move money out of Malaysia to invest in other countries.

Worries remain for the Ringgit especially on fears it will further decline against the US Dollar.

Overall

The rate cut was expected albeit earlier than most predictions. BNM’s intention to “preserve the degree of monetary accommodativeness” and “support a steady growth path” is viewed positively.

The overall boost to the economy, reduced loan payments, and increased consumer spending power may be just what Malaysia needs in the current times of global financial worries.