Buying a home is a huge commitment and will take the average homeowner up to 35 years to fully repay. Hence, you should be protecting this investment even when you are no longer around to finish paying for it due to unforeseen circumstances.

However, close to half of the Malaysian population do not see the need to get themselves protected.

Based on Bank Negara Malaysia’s (BNM) insurance statistics, life insurance coverage among the local population has become stagnant in recent years, with coverage remaining at 55 per cent for the past few years while for the lower income household segment, the rate drops to about 30 per cent. Providing a home for your dependent is a good thing, but if the home loan is not settled in full, it can turn into a burden for your loved ones in the event of death or total permanent disability (TPD) if you don’t have mortgage insurance.

In the event of death or TPD, a mortgage insurance policy frees the borrower’s dependents from any debt as it is designed to pay off the remaining debt on repayment mortgages.

Mortgage Reducing Term Assurance (MRTA) – life insurance plan with decreasing sum assured over time, and it used just to cover your home loan owed to bank.

This plan is usually offered by the bank you are getting the mortgage from, as it is used as protection for the bank in case of misfortunes that stop you from servicing the loan.

Mortgage Level Term Assurance (MLTA) – alternative for a borrower who is looking for a life insurance which offers protection plus savings and in some policies returns on the premium.

This is a personal plan, where you and your dependents are financially protected when you are no longer around, or have lost the ability to generate income.

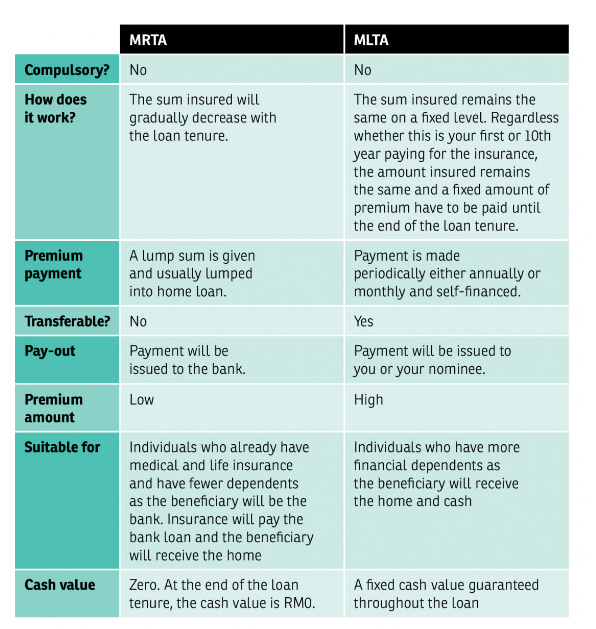

Comparison Between MRTA & MLTA

Which mortgage life insurance do I need?

The MRTA is most suitable for those who have adequate standalone life and medical insurance, and do not have many financial dependents. This type of insurance will only take care of your home loan, if it is not fully repaid in the event of TPD or death. Your family will not get a single cent from the policy in these events, as the beneficiary is the bank, not your family members.

MLTA is best for those who need an extra financial protection in the worst case scenario, as it also has a cash value at the end of the policy. This is best for those who have many financial dependents, for example young children and a stay-at-home spouse.

Is it Worth Having?

Most mortgage officers recommend mortgage life insurance (either MRTA or MLTA) when buying a new home. However, before committing to an insurance policy, it helps to do as much research as you can on the product.

Mortgage life insurance is aimed at providing security to your loved ones from being burdened by home loan repayments if you pass away or are afflicted by permanent disability. However, if you do not have anyone to leave your property to and money is tight, getting a mortgage life insurance may not be your highest priority. For those with dependents however, it’s worth considering.

What do you stand to lose if you do not have a MRTA or MLTA?

Short Term

If you are planning to pay off your mortgage within a few years, then an MRTA or MLTA may not be on the top of your list.

Long Term

However, if you are planning to service it for the next 30 to 35 years, and especially if you are co-buying with someone else, it will be best if you are protected.

For example, if you are purchasing a property with your spouse, and each will be paying 50% of the repayment every month, a death or permanent loss of income may be a huge blow on the couple’s finances. Having a mortgage life insurance will provide you the peace of mind that you will not lose your property even if the other person is unable to pay for the mortgage.

How much do I need to pay?

How much premium you need to pay for your MRTA or MLTA is subject to your age, loan amount and your loan tenure. The older you are and the higher the loan amount, the higher the premium you will have to pay.

Just like purchasing life or health insurance, if a person is diagnosed with a certain illness, the insurance company has the right to reject the policy or there will be extra loading in the premium. It depends on how severe the illness is and will only be determined after a medical examination by their panel doctors.

Following is a comparison of the estimated payout between MRTA and MLTA based on insurance cover for the sum of RM450,000 using 6% interest over 30 years starting in 2018 for a 28-year-old homeowner:

[table type=”table-bordered”]

| Age | ||

| Property value | ||

| Financing percentage | ||

| Financing/coverage | ||

| Interest rate* | ||

| Premium | RM357.13 (monthly) |

|

| Total cost (30 years) | ||

| No claim cash back (30 years) | ||

| If payout of insured amount happens in 2020 |

[/table]

* These figures are used as reference as the interest rate will differ from insurer to insurer; refer to your original policy for the actual terms.

With skyrocketing property prices, most homebuyers today have no choice but to pick the longest loan tenure possible to reduce their monthly loan repayments so they will likely be paying for their property for over 3 decades.

Understanding what you are purchasing is crucial in managing your money. If you are unable to pay the premium of MRTA, you can opt to finance the premium into the loan and thus the loan instalment will increase. You will also be paying extra interest as the bank is advancing the money to you to pay the premium.

If you need personal consultation on MRTA and MLTA, do can consult :-

Call / Text / Whatsapp Sam 012-6341950